Fast-moving changes to Washington State’s estate tax and capital gains tax may reshape estate planning priorities for many Washingtonians going forward. On May 20, Governor Ferguson signed into law Engrossed Substitute Bill 5813. Described as “[a]n act relating to increasing funding to the education legacy trust account for public education, childcare, early learning, and higher education by creating a more progressive rate structure for the capital gains tax and estate tax,” the law substantially impacts Washington’s capital gains tax and estate tax rates and exclusions.

Washington Capital Gains Tax

The law change applies an additional 2.9 percent excise tax on capital gains exceeding $1 million from the sale of long-term capital assets in Washington. This new tax is layered on top of Washington’s existing 7% capital gains tax, resulting in a combined 9.9% tax rate on capital gains exceeding $1 million. The tax will be applied retroactively to sales occurring on or after January 1, 2025.

Washington Estate Tax

ESSB 5813 also impacts Washington’s estate tax.

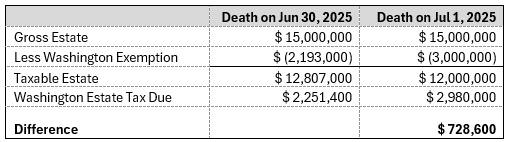

First, the individual Washington estate tax exclusion amount is increased from $2.193 million to $3 million for persons dying on or after July 1, 2025. The law also provides updated guidance on annual inflation adjustments to the exclusion amount starting January 1, 2026.

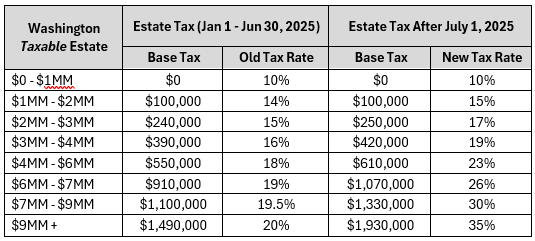

Second, the Bill increases Washington estate tax rates for decedents dying on or after July 1, 2025. The changes significantly impact the tax due on taxable estates over $1 million, as demonstrated in the table below:

To see the impact of these changes, consider the change in Washington estate tax on a $15 million Washington estate for a person dying on June 30 versus July 1:

Finally, the legislation increases Washington’s qualified family-owned business interests’ deduction to $3 million. The legislation also establishes that a “qualified nonfamilial heir1” may take estate tax deductions relating to inherited farms and farming equipment.

We will continue to track the effects of ESSB 5813 and other legislation impacting Washington residents. To discuss issues specific to your circumstances, contact one of our Estate Planning attorneys.

—

1 Qualified nonfamilial heir” means an employee of a farm who materially participated in the operation of the farm.